ReFi your payday, title, or flex loan to save money and actually pay it off.

BetterFi is a non-profit 501(c)(3) economic justice enterprise and certified Community Development Financial Institution (CDFI).

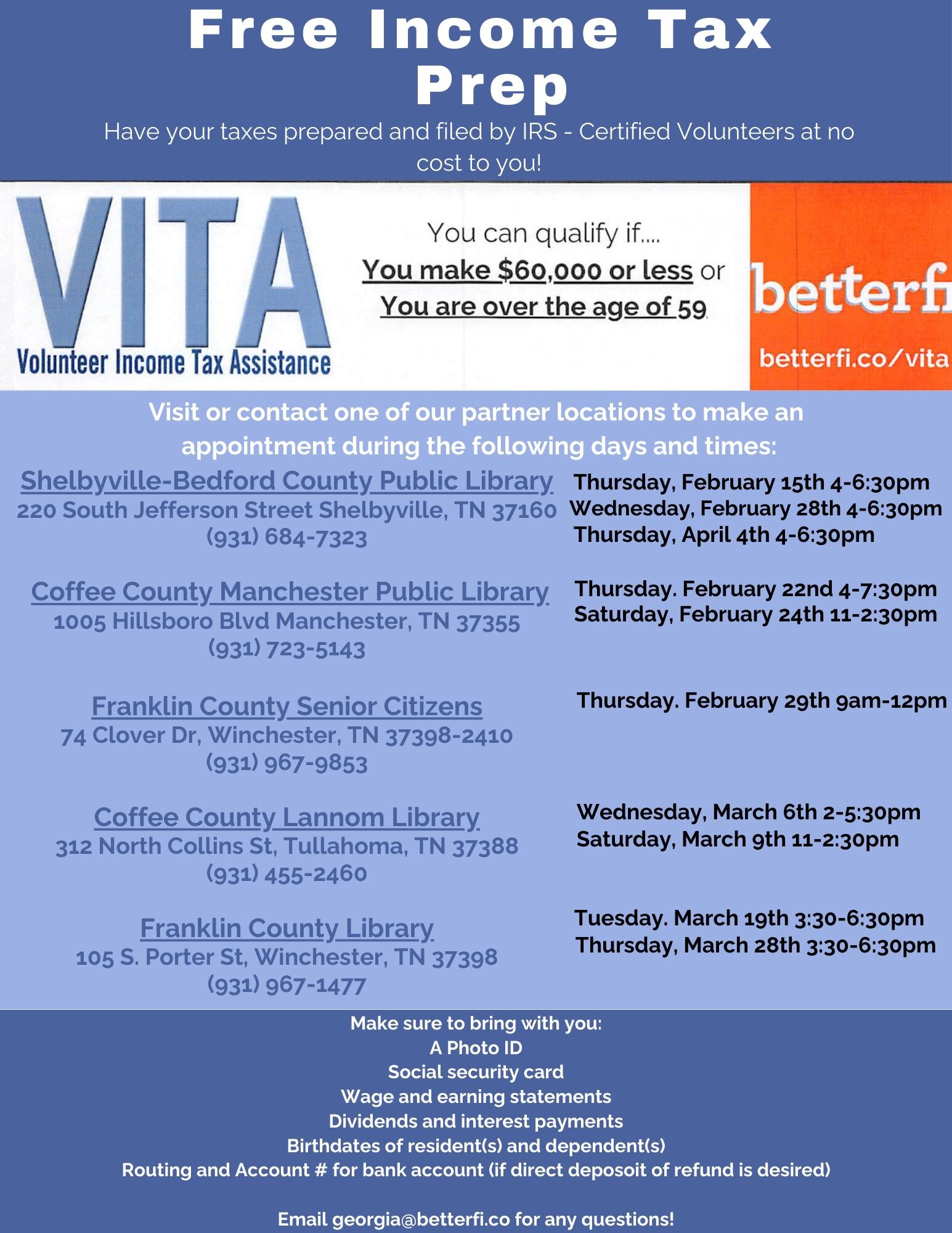

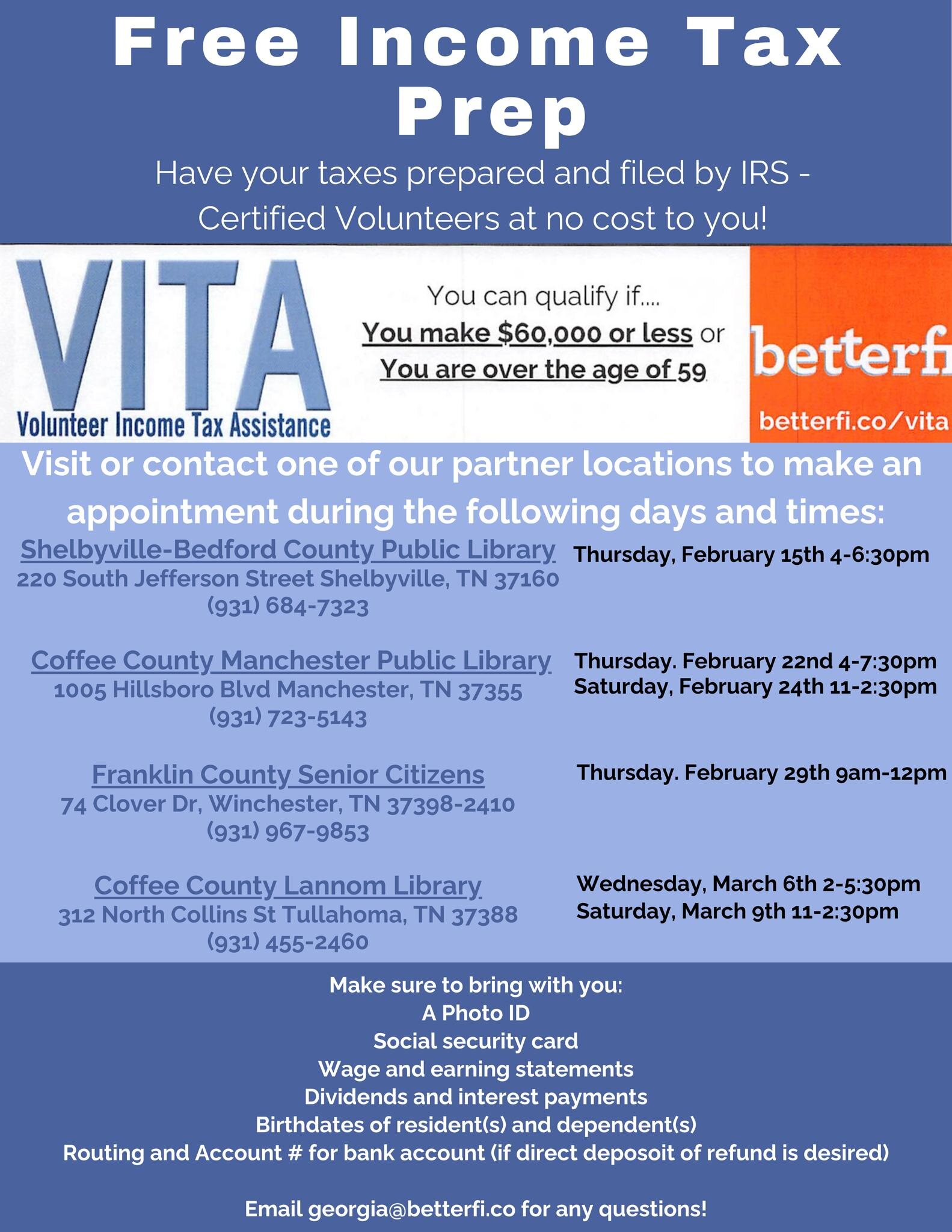

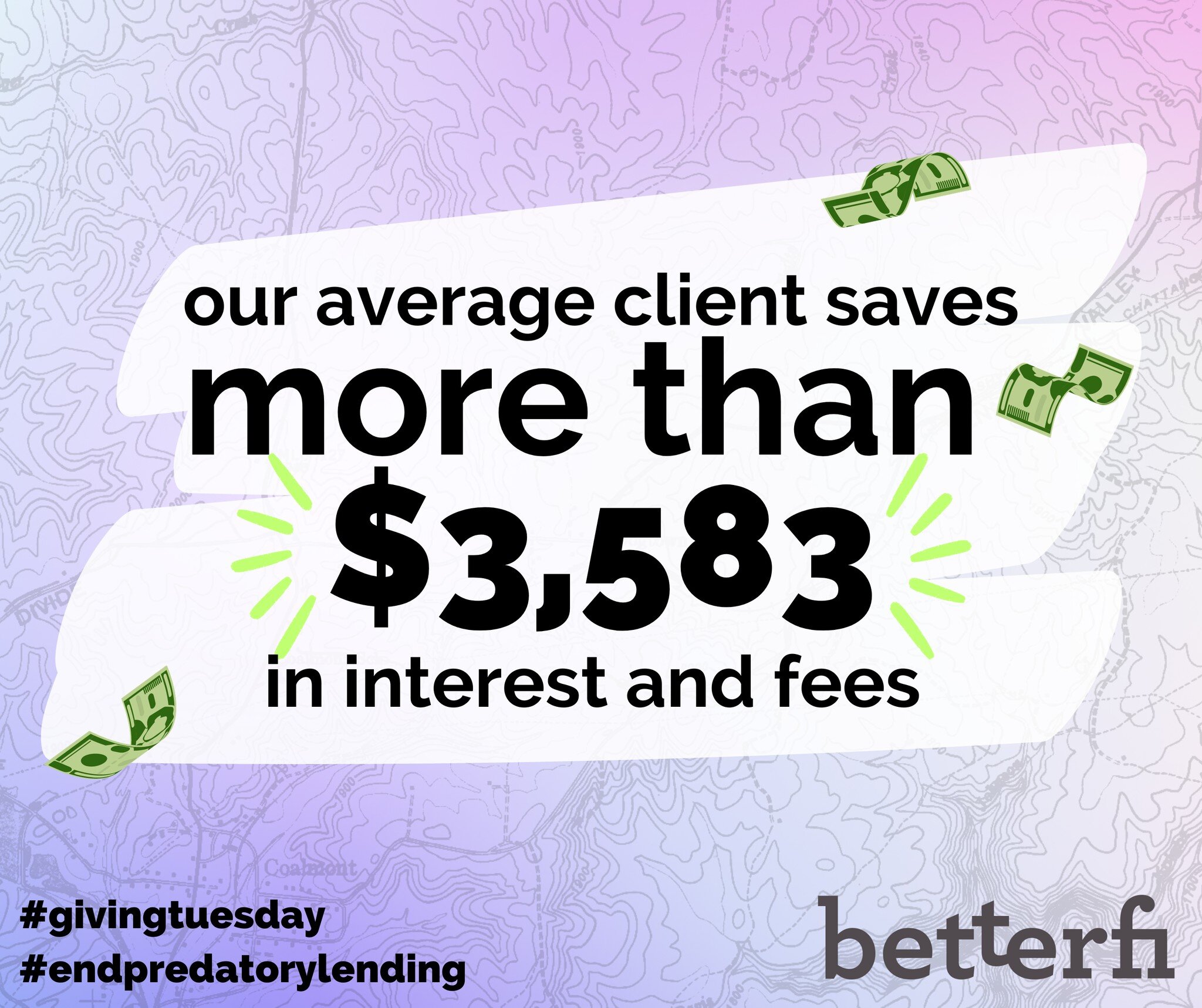

We provide affordable installment loans and complementary financial programming like coaching as a pathway out of debt traps and toward financial fitness.

When our clients refinance a payday, title, or flex loan with us, they:

💸 Pay less each month

💰 Pay less overall

📈 Build their credit score

🏁 actually pay off their loan

Together we can #ENDPREDATORYLENDING.

Tees & Sweats

Spread the word and support our mission to #ENDPREDATORYLENDING.

Part of the proceeds of every tee or sweatshirt purchase made at Bonfire goes directly to supporting our work and our mission.

Starting in

Grundy County

The South Cumberland Plateau is home to 6,855 underbanked households.

That means that 6,855 households rely on alternative financial services such as payday or car title loans -- loans that in Tennessee can have an effective annualized interest-and-fee rate of as high as 460%. These individuals and families can pay hundreds in interest and fees every month yet never pay down their loan, and this count of underbanked households does not include any families that are “unbanked” and have no active bank account.

With the assistance of the University of the South, the South Cumberland Community Fund, and Tower Community Bank (among others), BetterFi's pilot is ongoing in Coalmont, Tennessee.